When you think about your economical upcoming, do you really feel self-assured or confused? Suitable fiscal setting up commences with a realistic evaluation of your respective recent economic scenario. You'll have to compute your Web worthy of to possess a distinct starting point. From there, setting SMART plans can manual your limited and long-phrase fiscal procedures. But how precisely can these ambitions completely transform your financial wellness, and what measures in the event you take following to ensure you're not just surviving, but really thriving fiscally? Let's take a look at how an in depth, actionable system could change the study course of your economic daily life.

Being familiar with your financial position could be the cornerstone of productive fiscal arranging. Being aware of where you stand fiscally includes a clear comprehension of your monetary well being and Internet truly worth. What this means is You'll have to compile and review specific info regarding your assets and liabilities.

Your Internet worth is basically the distinction between what you possess (your belongings) and Whatever you owe (your liabilities). Belongings involve income, investments, house, and the rest of worth you have. Liabilities, on the other hand, encompass your debts, like loans, mortgages, and credit card balances.

To accurately evaluate your economical well being, you must compute your Internet value by subtracting your overall liabilities out of your whole property. A optimistic net truly worth signifies you have a lot more belongings than liabilities, suggesting a more healthy economical standing. Conversely, a damaging net really worth exhibits that your liabilities outweigh your belongings, signaling a need for quick focus and adjustment in the economical approach.

It is very important to on a regular basis update this calculation to track your money development with time. Further, comprehension your financial wellness just isn't pretty much realizing your latest posture but examining the trends with your money journey.

You should study adjustments with your asset values and legal responsibility balances, assess how They are impacting your Web really worth, and recognize any prospective pitfalls or prospects for enhancement.

When you've assessed your economic standing, it is important to established clever monetary objectives to information your upcoming endeavors. To start, let's differentiate among your limited-expression goals and your very long-time period visions.

Small-phrase aims usually span a duration of up to 3 a long time and could possibly contain conserving to get a down payment on an auto, creating an emergency fund, or paying out off significant-interest debts. These objectives in many cases are tactical and very centered, requiring frequent review and adjustment. However, your lengthy-term visions prolong outside of a few years and will encompass preserving for retirement, funding a child's schooling, or obtaining a home. These require a strategic technique, demanding endurance and persistent effort.

When location these objectives, You will need to take into account numerous variables for example possible money growth, inflation prices, and modifications within your economic conditions.

To set these ambitions successfully, you should make them distinct, measurable, achievable, relevant, and time-sure (Intelligent). As an example, as an alternative to vaguely aiming to "preserve more money," specify "I will preserve $300 regular monthly to a $10,800 unexpected emergency fund in the next three decades." This clarity boosts your concentration along with the likelihood of reaching your target.

In addition, combine your goals with your individual values and lifestyle Choices to guarantee they remain motivating and aligned with your broader life ideas.

Routinely revisiting and adjusting these plans is important as your money scenario and priorities evolve.

Together with your financial goals clearly described, it's vital to create a spending plan that paves the way in which for achievement. This means not merely monitoring your profits and bills but will also generating strategic selections that align with all your long-time period targets. A very well-crafted finances functions to be a roadmap, guiding you towards fiscal stability and growth.

To start with, assess your earnings sources and categorize your expenses. You'll need to become meticulous in recording where by each and every dollar is allotted. This process is critical in figuring out places in which you can Slash again, therefore rising your price savings price. Remember, even modest adjustments as part of your shelling out practices can tremendously affect your economic potential.

Next, prioritize the establishment of the crisis fund. This fund is an important buffer in opposition to unforeseen financial shocks, for instance health-related emergencies or best retirement plans for young adults unexpected task decline. Preferably, you ought to intention to save lots of at the least a few to six months' worthy of of dwelling expenditures. This proactive action not only secures your financial foundation but also will give you peace of mind, making it possible for you to target other fiscal aims with no consistent stress of probable emergencies. On top of that, your Way of living possibilities Participate in a substantial position in productive budgeting. Go for sustainable and economically practical behavior. For instance, eating out significantly less often, picking out far more very affordable amusement choices, and working with public transportation can all be portions of a price range-welcoming Way of life. Just about every preference must support your overarching money objectives.

Taking care of your read more debt proficiently is essential for keeping financial balance and acquiring your lengthy-expression plans. In the region of debt management, It really is critical to know and hire approaches like financial debt consolidation and credit counseling. These tools can enormously streamline your money obligations and lead you towards a more secure monetary future.

Credit card debt consolidation entails combining various debts into an individual loan that has a reduce fascination charge. This system simplifies your payments and may decrease the sum you pay in desire, which makes it much easier to deal with your funds. You'll find that by consolidating, you can deal with an individual repayment plan, usually with more favorable conditions, which often can expedite your journey out of financial debt.

Credit history counseling, Then again, gives Specialist steering on taking care of your debts. Partaking by using a credit history counselor can assist you fully grasp the nuances within your fiscal circumstance. They might offer customized tips on budgeting, handling your paying, and negotiating with creditors to probably reduce interest rates or create possible repayment strategies.

It truly is an academic useful resource that also holds you accountable, which can be a must have in retaining fiscal self-control.

It is also smart to frequently review your debt management plan. Economic circumstances transform, and staying proactive about changing your strategy could help you save from probable fiscal pressure. Try to remember, the target is usually to click here not just regulate your financial debt but to take action in a method that supports your Total financial wellbeing.

You could notice that shifting from controlling credit card debt to specializing in expenditure solutions opens up a brand new spectrum of economic prospects. While you navigate this terrain, comprehending the assorted landscape of financial investment choices is vital to maximizing your financial growth.

First of all, the inventory market offers dynamic opportunity for funds appreciation. By getting shares of general public companies, you are fundamentally purchasing a stake inside their foreseeable future earnings and progress. Nonetheless, the inventory current market might be unstable, requiring a well balanced method and complete exploration.

Real-estate investment decision stands as being a tangible asset that ordinarily appreciates as time passes. No matter if you happen to be getting Attributes to rent out or to offer in a earnings, housing can provide equally continual profits and prolonged-phrase capital gains. It requires considerable money upfront but is usually a dependable hedge towards inflation.

Mutual funds and index resources present a means to diversify your investments across quite a few belongings. Mutual funds are managed by industry experts who allocate your money across several securities, aiming to strike a balance in between chance and return.

Index money, However, passively observe a particular index such as the S&P five hundred, featuring a lower-Charge entry into the industry with Traditionally steady returns.

Bonds give a additional conservative financial commitment avenue, presenting frequent income by means of fascination payments. They're commonly safer than shares but present lessen return possible.

Emerging expense classes like copyright and peer-to-peer lending existing modern-day options. copyright, while extremely unstable, has demonstrated substantial expansion possible.

Peer-to-peer lending helps you to lend cash on to persons or businesses, earning curiosity because they repay their financial loans.

And lastly, commodities like gold or oil give alternatives to diversify and hedge against current market volatility and financial shifts, however they come with their own individual set of hazards and complexities.

Checking out investment decision solutions gives a strong Basis for setting up your retirement financial savings. When you investigate the varied avenues for accumulating wealth, It really is vital to align your possibilities using your expected retirement age and wished-for Life-style.

You will discover that a effectively-structured portfolio not only grows your property but will also mitigates pitfalls as your retirement age strategies.

You should comprehend the significance of diversification. Spreading your investments across unique asset lessons—shares, bonds, property, and possibly treasured metals—allows manage danger and smoothens out returns as time passes.

It's also vital that you reassess your chance tolerance while you age; commonly, a shift in the direction of far more conservative investments is prudent while you close to retirement.

Tax factors Perform a fundamental job in maximizing your retirement price savings. Reap the benefits of tax-deferred accounts like 401(k)s and IRAs, which allow your investments to improve with no drag of yearly taxes, and think about Roth choices for tax-free withdrawals in retirement.

Be aware, nevertheless, that certain procedures govern when and how one can accessibility these resources without having penalties.

A further substantial factor is setting up for your unexpected. Insurance products and solutions, including annuities and lifestyle insurance, can provide further protection, making certain that you won't outlive your discounts or go away your dependents economically strained.

Lastly, It really is necessary to overview and change your retirement system periodically, Primarily after main lifestyle activities or substantial market variations.

This adaptive solution not simply safeguards your personal savings but in addition boosts your money resilience, ensuring you might be well-geared up for a comfortable retirement.

Successful financial setting up hinges in your capacity to assess your existing monetary standing, set realistic objectives, and diligently control your budget and credit card debt. Discovering numerous investment selections and organizing for retirement are essential actions toward securing your money upcoming. Regularly revisiting and modifying your fiscal approach ensures it continues to be aligned using your evolving money desires and ambitions. Embrace these procedures to navigate your economic journey with self-confidence and precision.

Joshua Jackson Then & Now!

Joshua Jackson Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Earvin Johnson III Then & Now!

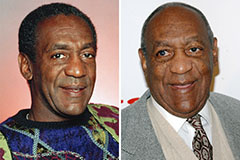

Earvin Johnson III Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!